Take the Risk out of Your Retirement

Supplement your retirement income with an investment vehicle that gives you better peace of mind.

The Future is Uncertain

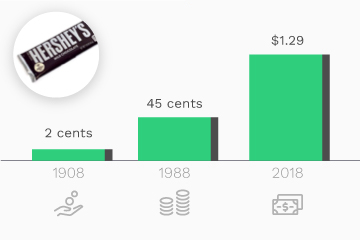

No one knows for sure how much interest rates will be in the future, or what will happen to the cost of living, or how much tax we will pay on our income 10, 20, or 30 years from now.

There are big swings in the markets

The cost of living is always rising

Tax rates are unpredictable

Related Reading

401Ks/IRAs Don’t Protect Against Those Uncertainties

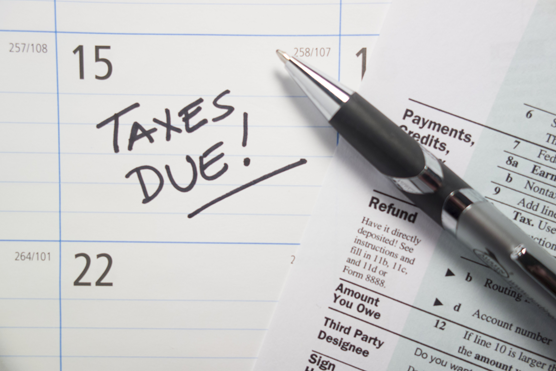

Your 401K and IRA can increase in value when the market is doing well, and decrease dramatically when it’s down. Unless you have a Roth IRA, the income you withdraw at retirement might be taxed at a really high rate! Furthermore, these plans can be costly.

When you retire, you will be taxed on the money you take from your 401(k)/IRA

When you retire, you will be taxed on the money you take from your 401(k)/IRA When the market goes down, so do your account balances

When the market goes down, so do your account balances 401(k)s/IRAs have multiple layers of fees which are subject to change

401(k)s/IRAs have multiple layers of fees which are subject to change

Related Reading

What should we be worried about today?

It’s hard to predict what tomorrow will bring. The further out we look the harder it is to trust the predictions we make. But we can use history and experience to make informed guesses.

Our next market correction is likely to be big

Someone is going to have to pay this bill!

Related Reading

It’s time to put another arrow in your quiver

Now, more than ever, it’s important to make sure that at least a portion of your retirement savings is protected against these uncertainties and gives you peace of mind. You can use a traditional death benefit, an IUL life insurance policy, to provide low-risk living benefits.

How does it work?

-

1. Zero is your hero. Properly structured IULs prevent you from experiencing losses.

1. Zero is your hero. Properly structured IULs prevent you from experiencing losses. -

2. When you use an IUL for income, you are borrowing not withdrawing, so you keep earning interest on the total value.

2. When you use an IUL for income, you are borrowing not withdrawing, so you keep earning interest on the total value. -

3. Income you borrow from your IUL while you are living is not taxed.

3. Income you borrow from your IUL while you are living is not taxed.

Related Reading

Make sure all your arrows are well designed and fly straight.

Not all IULs are structured the same way. Before you add an IUL to your retirement strategy you need to be sure it’s designed to perform the way you want it to.

Balance the highs and lows with an agreed cap on gains and floor on loss

Balance the highs and lows with an agreed cap on gains and floor on loss Know when you will have enough equity in the policy so you can borrow

Know when you will have enough equity in the policy so you can borrow Know how much you have to contribute and when to lower your costs

Know how much you have to contribute and when to lower your costs

Related Reading

An IUL is not for everyone

Just like most investments, not everyone can take advantage of the benefits an IUL can offer and not everyone is able to make the commitment or eligible to hold an IUL policy.

You must be in reasonably good health

You must be in reasonably good health You have to have post-tax income you can invest in your retirement of at least $15K annually

You have to have post-tax income you can invest in your retirement of at least $15K annually You have to be willing to forego a tax deduction today for future benefits

You have to be willing to forego a tax deduction today for future benefits

Related Reading

Who is the Better Money Method?

The Better Money Method is a company and an approach created by Terry Laxton. Meet Terry. He believes in his approach and also makes a living helping people use it.