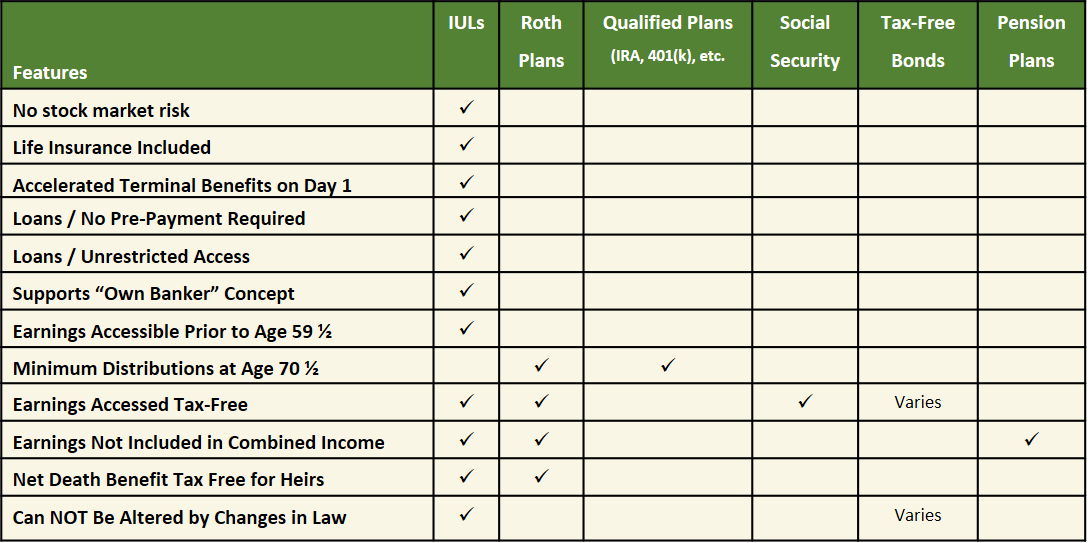

How does the Better Money Method and IULs stack up against IRAs, 401(k)s and other plans

The Better Money Method is a customized approach to leveraging a life insurance product called an Indexed Universal Life (IUL) product to deliver living benefits. See how it stocks up to traditional IRAs, 4019k) Roth plans and more.

Important Notes:

Roth Plans

Both the Roth IRA and the 401(k) have income and contribution limits. Currently, dollars are put in after tax, so your retirement income is tax-free. However, given the fact that “tax-free” income from tax-free bonds is currently used in the formula to calculate taxes on Social Security income (see below) I don’t see how it is unreasonable to assume the same rules will be applied to “tax-free” income from Roth Plans sometime in the future.

Qualified Plans

You know qualified plans by their more common acronyms such as 401(k), an IRA, a 403(b) etc. These were all created by sections of the tax codes. Therefore, they were created by law and can be changed by the government at any time!

Tax-Free Bonds

These are bonds sold by various governmental agencies. As stated below, the “tax-free” income from these bonds is used to trigger a tax on your Social Security income. They can also be taxed in other ways, i.e. one state may tax the tax-free income on bonds from another state.

Pension Plans

These are subject to market loss because they are, mostly, dependent on market returns and company stock to pay their benefits. Read Here’s What to Know About Retirement Income: From IRAs to Pensions, Find out Which Is Taxable. Numerous articles have been written about the number of corporate pensions that are grossly underfunded. Read S&P 500’s Biggest Pension Plans Face $382 Billion Funding Gap. It’s truly amazing how, in an up market, many of these pension funds have gotten even further behind in their funding over the last few years.

Is Social Security income taxable?

Yes. All other income come like pension plans, qualified plans, “tax-free” bond income and ½ of your Social Security income are added together to determine how much of your Social Security will be taxed and at what rate. Your Social Security income is taxed on a sliding scale up to 85%, once all income from all these sources of income reaches $45,000 a year for a married couple. Note, Social Security income was not taxable to start with. It only became taxable under one of the tax “reform” laws between Ronald Reagan and Tip O’Neill.

Can the rules be changed by law?

For Roth’s, Qualified Plans, Social Security, Tax-free bonds and Pension plans the simple answer is yes. They were created by laws and can just as easily, be changed by laws at the whim of Congress. On the other hand, IUL’s are contracts that are protected by the US constitution. Therefore, they cannot be changed by Congress. A contract that is entered legally, cannot be changed by any third party – absent fraud. That does not mean that Congress cannot change the requirement for IUL’s in the future. But, if they did all existing IULs would be grandfathered by the constitution. That happened under the same Ronald Regan and Tip O’Neill tax “reforms” that created the tax on Social Security. That is one of the reasons you may not have heard of an IUL. Those changes made them harder for most people to understand. It is easier to say, “buy term and invest the difference. Only a few people have taken the time to really understand the power of the IUL.

If you still have questions, please contact us and we’ll be happy to answer them.