Spoiler Alert: It depends.

Social Security benefits are not taxed. True or false?

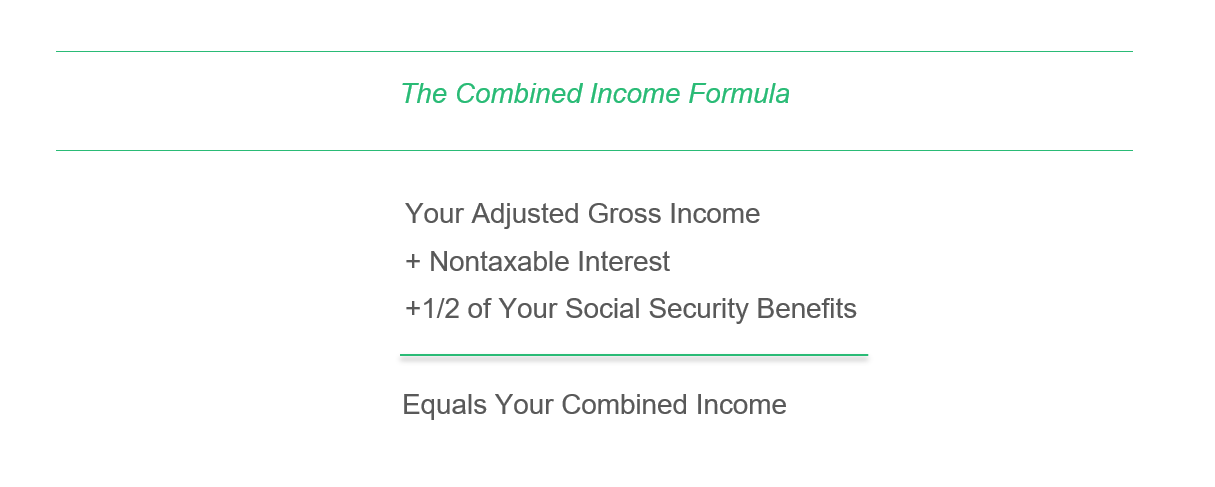

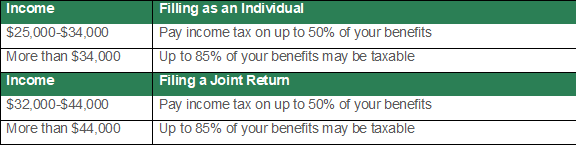

There is much confusion among retirees today regarding the tax treatment of Social Security benefits. The main question is, “Are Social Security benefits taxable?” The answer is it depends on your income level and your type of income. Your benefits generally are not taxable if half of your benefits plus all your other income, is less than $25,000 if you are single ($32,000 if you are married filing jointly). Up to 85% of your Social Security benefits are subject to income tax if half of your benefits, plus all of your other income is more than $34,000 (for singles) or $44,000 (married filing jointly).

Up to these levels it is taxed at 50 cents for every dollar of Social Security income. Once you exceed these limits, up to 85% of your benefits are subject as part of the Combined Income Formula.

Here’s another way of looking at this information.

Here’s Where Things Get Interesting.

Let’s say you have exceeded the minimum threshold, and you’re looking at the second scenario in which 85% of your benefits may be taxable.

- IRA withdrawals are taxable too, but not on the same schedule as Social Security benefits. Withdrawals from traditional IRAs are taxed as regular income based on your tax bracket for the year in which the withdrawal is made.

- Both IRA and Social Security benefits grow over time, so delaying the withdrawal of either of these benefits will result in higher income later. For example, if you withdraw IRA money first (while in your 60s) and Social Security income at age 70, you effectively are choosing lower IRA income and higher Social Security income.

- The withdrawal of IRA income in the same year as the withdrawal of Social Security income could trigger taxation of Social Security income. The IRA money could cause you to exceed the income taxation threshold mentioned in the first paragraph.

What About IRAs?

Depending on your income level, another strategy to consider is the conversion of traditional IRA assets into a Roth IRA. When you convert a regular IRA into a Roth IRA, your new Roth IRA will not be counted when the government is determining your Required Minimum Distributions. This will give you more flexibility to withdraw money when the timing is right, further enhancing your tax minimization strategy. However, you must be under the maximum allowable income to fully contribute to a Roth IRA. At the time of writing, those maximum levels are $120,000 for a single or head of household or $189,000 if married filing jointly or a qualified widow or widower.

Keep What is Rightfully Yours!

Don’t hand over your retirement savings to Uncle Sam! Like it or not, taxes greatly impact the percentage of hard-earned Social Security benefits you will ultimately keep. The above strategies are well-accepted and believed by the financial planning community as your best options. But, rolling over an IRA into a Roth IRA incurs, what could be, major taxes. There are far better strategies not normally known within the financial planning industry. That is what the Better Money Method is all about.

For individuals lucky enough to have $1,000,000 or more in their IRA, 401(k) or other qualified plans, there is a way to get that money re-positioned in way that offers much greater benefits than a Roth conversion. With the Better Money Method, you can re-position that money (assuming you have $1,000,0000 or more in a quaffed account) with little or no out of pocket taxes, eliminate Required Minimum Distributions (RMDs), eliminate all future taxes on that money, eliminate any market risk and still get market gains.

The best way to avoid RMDs, taxes on your social security and avoid market losses is by following the Better Money Method. When you’re ready, contact us to learn more and we’ll tell you how to get started. Alternatively, you can download a summary of the book The Better Money Method: A Better Idea for Retirement or purchase it on Amazon.

This material has been prepared for informational and educational purposes only. It is not intended to provide, and should not be relied upon for, accounting, legal, tax or investment advice. Please consult with a professional specializing in these areas regarding the applicability of this information to your situation.