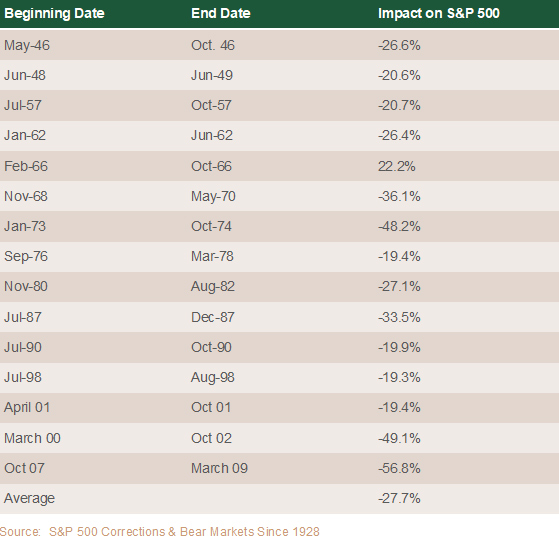

What history tells us about the size and length of the next bear market

The last bear market we experienced here in the United States ended in March of 2009, almost nine years ago as of the writing of this article. Since then, we are currently in the second longest running bull market in history. We’ve experienced several market corrections, defined as declines greater than 10% but lower than 20%, but no bear market.

70+ Years of History of Bear Markets

What does that mean for you in terms of your retirement savings?

The most recent market correction, again at the time we wrote this article, began on January 26th, 2018 and lasted 13 days with a decline of 10.2%.

If you began your traditional qualified account in 2010, whether it’s a 401K or IRA or some other qualified income retirement savings account, you have experienced close to 8 years of steady gains. However, it is highly unlikely that the market will continue this way. And, when there is a market correction, or we move into a bear market, accounts that are tied to the market will lose money and that loss can be devastating to your ability to reach your desired income levels in retirements.

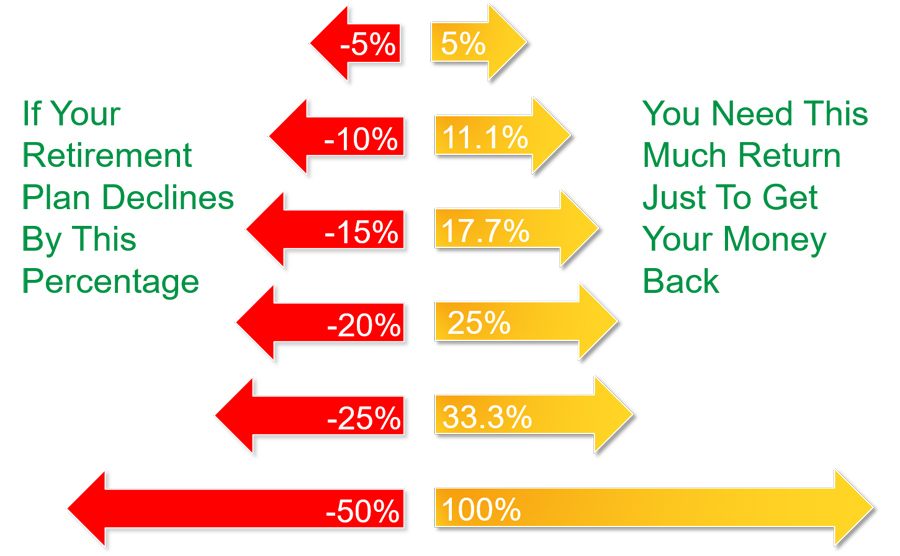

How much does it take to recover from a market loss?

There is not a direct correlation between how much you lose and how much it takes to recover those losses. If you lose, as an example, 25% of your account’s value, it will take a 33.3% gain to get back to where you started. Not gain anything, not earn anything, just get back to where you started.

Recovering from Market Losses

Let’s look at that in terms of actual numbers.

If Timmy invests $100.00 and the market goes down 50% he now has $50.00.

If the market goes back up 50% he doesn’t end with his original $100. Instead, he has $75.00. The market has to go up 100% before he gets back to his original investment of $100.00.

Every time the market goes down, whether it’s 5%, 10% or 25% or more, your account balances are suffering the same effect. That’s why it takes so long to catch up from a downturn in the market.

To make matters worse, you suffer an opportunity cost of not earning interest on the balance you haven’t made up yet! So, you may never catch up.

Many advisers will tell you “Don’t worry about it. You are in it for the long-term.” They are right about the fact that you are in it for the long-term, but they are very wrong to say you shouldn’t worry about the impact losses have on your retirement plans.

We’ve just described exactly why you SHOULD avoid losses at all costs! They are very difficult to recover from and they have extremely costly and long-term effects on your final account balances. If you can put your retirement savings into an account that has a floor of zero on loss, even if you cap your gains at 15%, you will easily come out WAY ahead of any account that experiences unrestrained losses and gains. Find out how to get started today!