Loss Hurts

Many nest eggs end up being broken due to losses incurred in the markets. People end up digging financial holes that they never get out of. It has been said that the first rule of holes is that when you find yourself in one, stop digging!

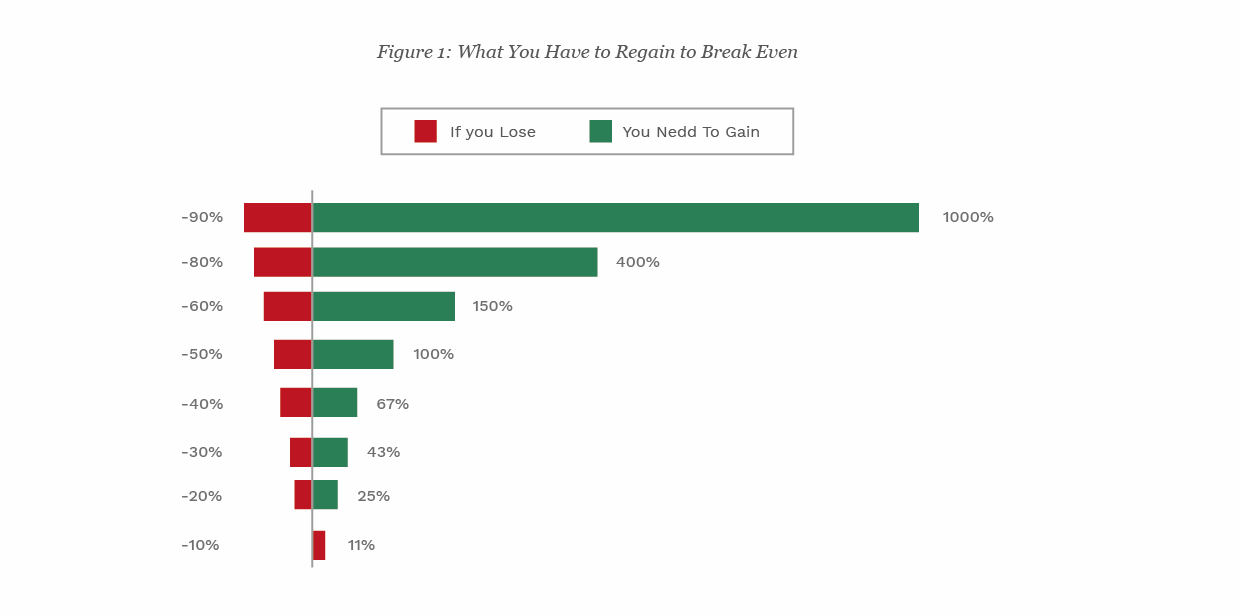

Consider this “risk riddle”

Joe had $100K in a financial product and it lost 50%. Now’s it’s worth $50K. How much, in percentages, does Joe have to gain to get back where he started?

Did you answer 50%? That’s a very common answer, but wrong.

If Joe loses 50% in the market, his account must increase 100% just to get back to his starting point!

Let’s examine why.

If you lose 50% on $100K and are down to $50K, a 50% gain would only get you back to $75,000. After a 50% loss, you need a 100% gain to get back to your starting point! Remember what I said about what to do when you are in a hole? Stop digging!

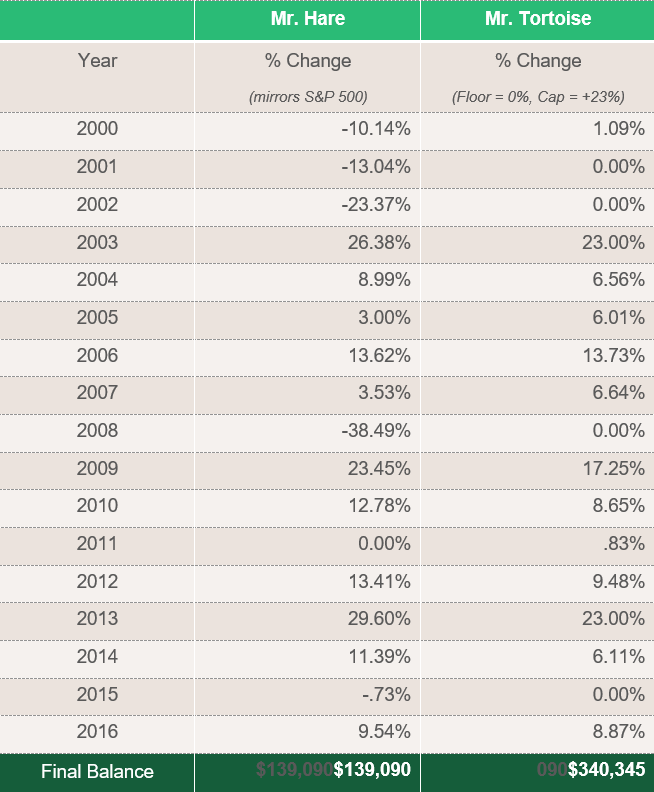

Mr. Hare and Mr. Tortoise

To help understand the impact of loss and the value of setting a floor on it – let’s play this out for 15 years. The following table illustrates what happens to two savers, Mr. Tortoise and Mr. Hare.

We will assume that in the year 2000 they both invested $100K. Mr. Hare is comfortable with accepting some risk, so he put his money in the market and his results were amazing! He was able to exactly mirror the results of the S&P 500 index, an incredible feat. Mr. Tortoise took a more conservative approach and put his money in an investment vehicle that earns up to 23% in the good years and 0% in the bad years.

Here you can see exactly how “Zero is your Hero” if you are willing to not earn ALL of the upside in the years that the market performs extremely well.

In the long run, the account with a 0% floor was just short of being DOUBLE the final balance of the account that experienced loss over time. Simply put, loss hurts, and especially over the long-term.

How many times have you heard from your advisers or friends and families “Don’t’ worry about it when your 401K and IRAs go down. You are in it for the long-term.” They are right! You ARE in it for the long-term and that’s precisely why you SHOULD worry about it. Slow and steady wins this race!

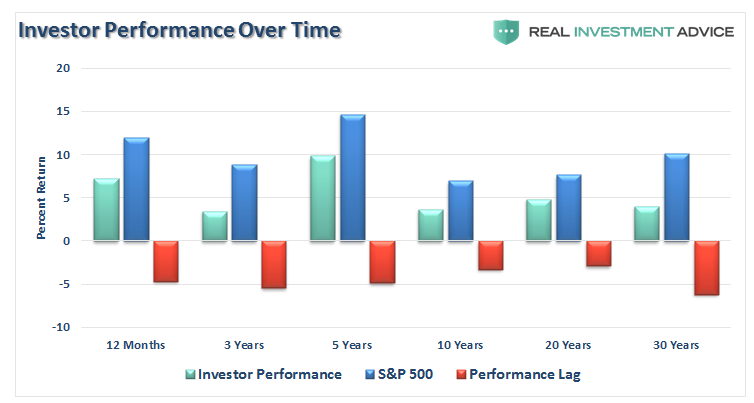

It’s very hard to “beat” or even match the S&P 500

In our example, Mr. Hare invested his $100K and achieved results that mirrored the S&P 500. Just so you know, that’s an EXTREMELY rare if not impossible feat. The promises that we buy into with our money are often not met by reality. Dalbar, a respected research firm, released their 23rd annual Quantitative Analysis of Investor Behavior study in early 2017. Their analytics covers the 30-year period ending December 31,2013. In 2016, the average equity mutual fund investor under performed the S&P 500 by a margin of -4.70%. While the broader market made gains of 11.96%, the average equity investor earned only 7.26%. The chart below shows how this gap has varied in size, but consistently present for the past 30 years.

Due to poor investment decisions, fees and commissions paid on investments and bad decisions made due to the emotional turmoil of the markets that cause us to buy when we should sell and sell when we should buy, investors significantly under performed the markets. Losses hurt us not only in the short term when our account statements come in the mail, but also in the long run with the lost opportunity cost of what those losses would have.

The bottom line: If you are in it for the long-haul, which is the premise behind investing to fund your desired lifestyle in retirement, embrace the idea that “Zero is Your Hero” and create a retirement plan with a 0% floor on loss.

This is one of the key tenets of the Better Money Method, creating a risk-free investment strategy for your retirement. Contact us to learn how you can get started.