Beware! Many funds with a great average rate of return will lose money

It’s entirely possible that you can invest in a mutual fund or account with a great average rate of return and still lose money. Let me explain how.

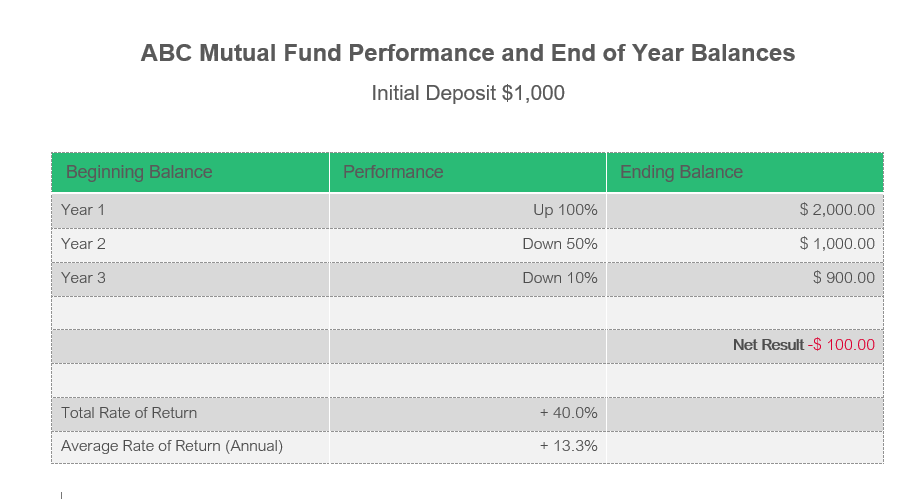

One of the key marketing statistics used to tell investors how a fund is likely to perform is “average rate of return.” The average rate of return is the average of the percent the fund went up or down over a certain period. Below is the average rate of return and account balances for ABC mutual fund (totally fictitious) over a 3-year period. In the below scenario, the account was opened with an investment of $1,000 at the beginning of year 1.

Legally, any Investment Adviser Representative can recommend the ABC Mutual Fund using the law of averages and claim it has experienced an average rate of return of +13.3% over the past three years.

However, that average is very misleading. An investor would expect, based on an average annual rate of return of 13.3%, to end up with something closer to $1,454 after three years but instead you can see this fund lost $100.00! At the end of the three years the account was down 10%.

That is why it’s so important NOT to analyze and choose your retirement accounts based on their “average rate of return.” To plan properly for your retirement, it’s very important to stay focused on net growth over time in your account balance and actual dollars.

You don’t put averages in a retirement account, you put dollars in!

Download a copy of this article.

Comments 2

Muchas gracias. ?Como puedo iniciar sesion?

Muchas gracias. ?Como puedo iniciar sesion?